On this recent post I detailed what progress I should be making after final exams finished. I am at home in Houston now and have somehow been distracted everyday.

On this recent post I detailed what progress I should be making after final exams finished. I am at home in Houston now and have somehow been distracted everyday.

This is no good. I’ve set out goals for myself and I have not met them. This needs to change. With whatever small amount of spare time I get during my two weeks in New York, I should try to:

- Finalize updates on Timber Trace website.

- Inquire about best options for opening 2nd brokerage account.

- Get Resumite ready to do business (finalize all sample sites).

- Add new content to online business everyday.

- Finalize traffic alleviation proposal on I-35 in Austin.

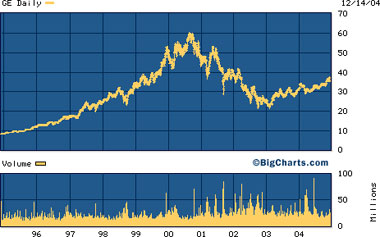

- Create new investment ideas.

- Have fun.

- Meet my goal of making $5,000 by 12-31-2004.

If you see me moseying around anywhere, make sure you ask me if I have first completed ALL of the above!

My weekly transfer of…

My weekly transfer of… One of my goals was to finish

One of my goals was to finish

I found

I found  Credit cards. Ughh.

Credit cards. Ughh. Today I cancelled a $5,000 CD account I started over a year ago. To date, I earned only $39 from interest. The interest varied every month between .5% and .75% annual interest. With rates that low, I feel some of the money would be better off in a different investment vehicle.

Today I cancelled a $5,000 CD account I started over a year ago. To date, I earned only $39 from interest. The interest varied every month between .5% and .75% annual interest. With rates that low, I feel some of the money would be better off in a different investment vehicle. Today when golfing with friends I realized how much I like golf just for the

Today when golfing with friends I realized how much I like golf just for the