When you can’t have something, you want it more. This fact of human nature can be exploited to save you money.

When you can’t have something, you want it more. This fact of human nature can be exploited to save you money.

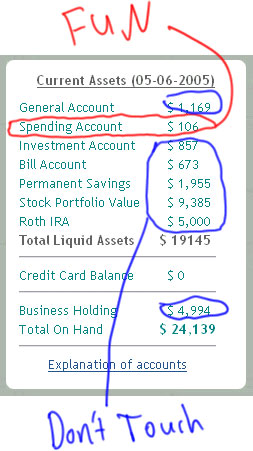

Personal Example:

Despite having built up a nice amount of cash from several businesses in my early college years, I would subconsciously deprive myself of money, making me “virtually broke” so I didn’t spend too much money.

I did this by just pretending I didn’t have any money in the bank. Unfortunately this method worked a little too well. I would only spend about $60 a month on entertainment, not a lot for a socially active college student.

My Remedy: The spending account.

I created another free account with BankOfAmerica and labeled it my Spending Account. This is the money I designate for spending on anything I want. This money is MEANT to be spent and not saved. It kept me from spending too much money, but also kept me from living like a total cheapass.

If I don’t have enough in the spending account, I don’t buy it.

Thanks to this method, I have a healthy amount of money to spend, and I don’t take it overboard.

-Nev

After this Financial Times article, I am now mentioned in 4 out of the 5 news sources needed to meet one of my medium term goals.