As previously mentioned, my camera died after a skydive from about 7 feet onto a concrete floor. I’ve dropped it many times in the past with no problem, but this proved a little much for it. It works sometimes, but barely.

So here’s saying goodbye to my old camera, it had a great run:

The best part about breaking something is you get to buy a new one! So I jumped on Ebay and bought this Casio Exilim EX-S500. It’s a great camera, and comes in a LOUD ORANGE COLOR, and I love loud things.

It cost me a cool $393…that includes shipping, shipping insurance and a 3-year warranty (Which would have been really useful with my broken camera right now).

On another note….

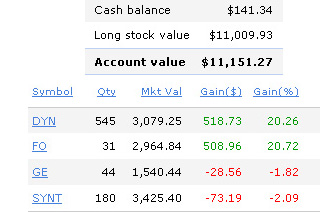

While I don’t keep up with the stock market all that frequently anymore, it seems everything has been doing really well lately. My current holdings are as follows:

I’m in these stocks for the long run, so I’m not selling anything.

It’s Friday, so it’s once again time to party!

-Nev