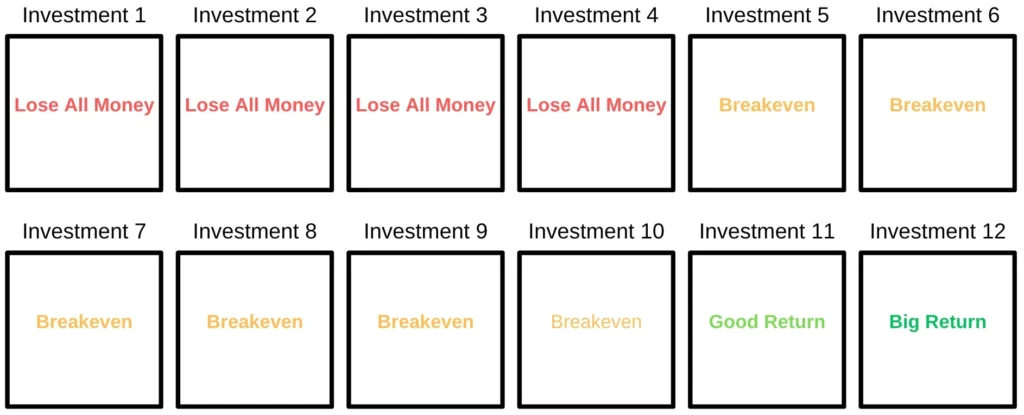

Some angel investing advice Dan Martell said Naval Ravikant gave him (paraphrased):

“Make 12 investments, all of the same size, over the course of a 4 year period.”

He said it roughly follows the old normal curve, where most of the investments will either be a washout or you breakeven, but 1 or 2 of those investments will return all the money:

You can see his advice here at this timestamp: 30:36