I set a limit buy price of $6.00 on Evergreen Solar (ESLR) a few months ago, and just found out it triggered, buying 330 shares. This is the first buy in my Roth IRA account. Now I need something other than common stock in this account.

I set a limit buy price of $6.00 on Evergreen Solar (ESLR) a few months ago, and just found out it triggered, buying 330 shares. This is the first buy in my Roth IRA account. Now I need something other than common stock in this account.

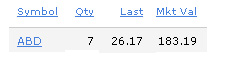

An even bigger surprise was the addition of Acco Brands (ABD) to my regular trading portfolio….because I’ve never heard of it. Apparently Fortune Brands spun off their office supplies division, so now I own 7 shares of Acco at around $26 per share.

I’m going to list this $183 as income.

I’ve got a new side business on the way, hopefully launching by my goal date of 8.28.2005. It will be a low maintenance operation once setup, but there is a lot of reading and researching to first be done on my part.

I won’t give away details just yet, but it has something to do with:

I am working on much larger projects with some business associates, making this one look like pennies. However, there is nothing wrong with having several small side incomes.