Today I logged into my ROTH IRA for the first time since I started it in March.

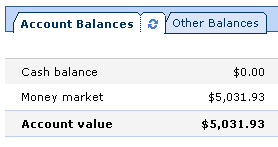

I put $5,000 into it and just left it there. I called Ameritrade for my username/password and found out that my account value is $5,032!

Apparently it was all sitting in some sort of money market account building interest. I’ll slowly start hunting for places to put that 5k.

On a different note……

I had a cool post prepared to put up, but I nixed it because I got a great business idea from it! No one has done anything like it before, and it can easily be a very very simple way to earn $1,000+ every month.

I’ll have the site and service fully operational within two weeks or a month max. No public details yet.

I’ve also found out that having my name so closely associated with this site has its drawbacks….when I try to negotiate a deal, people KNOW I have at least $X amount of money, so I can’t pull the “I can’t afford that!” routine.

-Nev