Here’s a question I’ve been getting more and more geared towards my business House Of Rave:

Have your sales gone down in the poor economy?

It’s actually a fantastic question and relatively interesting to hear different answers from different business owners.

So, have your sales gone down in the poor economy?

MY ANSWER:

YES…..but not in the traditional sense. Let me explain:

Most people expect that sales simply stopped coming in after the economic downturn, this hasn’t been true even though House Of Rave sells things people buy only on disposable income. In fact, if you never told me there was a “recession” going on, I probably wouldn’t have noticed too much….people still order all the time (although I’ve seen a very significant drop in big orders from large corporations).

The MAIN problem I’ve had which takes a DIRECT shot at lowering my sales is all the cool products are out of stock. Almost all of my previous best sellers are no longer being manufactured.

HouseOfRave sells “hard to find” and “unique” products….which often means “they don’t sell it in big stores”. This has been great so far, but a problem I’m seeing now is manufacturers are on tight budgets and don’t have the capital required to mass produce slower selling items. I may be able to sell 10 per day of an item, but a manufacturer might need to sell 10,000 of them per day to keep cash flow moving.

….so unless an item can move HUGE quantities quick, the product might be discontinued.

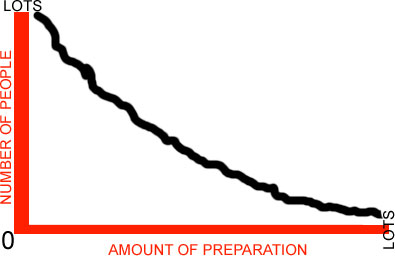

This has been the predominate way that my business has been affected. The cool part is, with more marketing and more effort I’ve been able to maintain and grow both the profit and sales of the business, but it’s required more effort than in the past (keep in mind I used to put NO effort into it at all). Before, I would just slap products on the site and they sold….it doesn’t seem to be quite as easy anymore.

Many smaller manufacturers and product patent holders are going out of business now. Think about it, to manufacture just ONE simple product you must spend hundreds of thousands of dollars for materials and labor, store them, then find people to buy them. Before you make even one CENT from the product, you could blow through a half-million dollars on credit. If the product is a flop (note the importance of beforehand PRODUCT RESEARCH) you’re screwed…..and I’m just using the example of small-scale manufacturing of novelty products.

While my business doesn’t have the extreme overhead of these manufacturers, I feel their pain indirectly when a cool product of theirs goes out of stock.