I came out of 2005 earning around $20,000 for the year just from side projects and while still a full time student. Not too bad, but not a living wage.

I came out of 2005 earning around $20,000 for the year just from side projects and while still a full time student. Not too bad, but not a living wage.

I am now graduated and can concentrate full time on the game of making money.

For my own reference, here is the money I brought in for 2005:

-Online Biz – Jan. – $ 502

-Work – $ 253

-Work – $ 281

-Ebay Sale – $ 100

-Change Jar – $ 55

-Online Biz – Feb. – $ 751

-Work – $ 271

-Change Jar – $ 30

-Rebate – $ 30

-Work – $ 229

–Lottery Experiment – $ 2

-Web Design – $ 100

-Online Biz – March – $ 946

-Syntel Dividend – $ 270

-Ebay Sale – $ 218

-Ebay Sale – $ 340

–Water Experiment – $ 5

-Work – $ 246

-Work – $ 248

-Online Biz – April – $ 836

-Web Design – $ 300

–Change Jar – $ 32

-Surveys – $ 55

-Books – $ 165

–Selling Notes – $ 105

-Work – $ 297

-Online Biz – May – $ 1,024

-SYNT Dividend – $ 21

-FO Dividend – $ 6

-GE Dividend – $ 10

–Work – $ 213

-Change Jar – $ 17

–Work – $ 167

-Online Biz – June – $ 718

-FO Dividend – $ 11

–Work – $ 274

–Work – $ 261

-Online Biz – July – $ 834

–Work – $ 304

-GE Dividend – $ 10

-SYNT Dividend – $ 11

-Change Jar – $ 35

–Acco Brands – $ 183

–Work – $ 210

-Books – $ 30

-Online Biz – Aug. – $ 804

-ACCO Dividend – $ 7

–Work – $ 228

–Change Jar – $ 76

-Online Biz – Sept. – $ 654

–Selling Pixels – $ 1,350

-FO Dividend – $ 11

-SYNT Dividend – $ 11

-GE Dividend – $ 9

-Online Biz – Oct – $ 1,120

-Misc. – $ 1,000

-Birthday – $ 200

–Online Biz – Nov – $ 1,630

–Change Jar – $ 115

–Online Biz – Dec – $ 1,801

—2005 Total – $20,021

There are some dividends and interest earnings missing, but nothing significant. I also do not publicly publish income made from partnerships I have going, as that violates other people’s privacy.

I ended the year with the following in my public accounts:

-General Account – $ 3,647

-Spending Account – $ 179

-Spending Account 2 – $ 350

-Investment Account – $ 2,234

-Bill Account – $ 1,379

-Permanent Savings – $ 3,342

-Stock Portfolio Value – $ 11,016

-Roth IRA – $ 6,680

-Emigrant Direct – $ 1,002

—Total Liquid Assets – 29,829

-Credit Card Balance – $ 0

-Business Holding – $ 1,647

—Total On Hand – $ 31,476

2006 will be the year I hope to firmly establish myself….or go really broke. Either way will be quite fun and teach me a lot :-)

$22 – Tubing down river for 6 hours.

$22 – Tubing down river for 6 hours. I had some visitors stay over in Austin this weekend and I was really expecting to completely exhaust my spending account. Fortunately, I could not find a single boat to rent this weekend, and certain people refused to let me pay for meals/drinks etc.. I wasn’t complaining.

I had some visitors stay over in Austin this weekend and I was really expecting to completely exhaust my spending account. Fortunately, I could not find a single boat to rent this weekend, and certain people refused to let me pay for meals/drinks etc.. I wasn’t complaining.

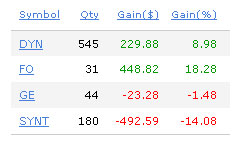

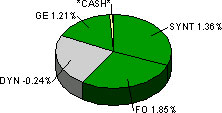

This chart shows the daily movement of my portfolio only.

This chart shows the daily movement of my portfolio only. A lot of buzz is going on about China and their emerging economy. If it’s all over the press, it’s old news.

A lot of buzz is going on about China and their emerging economy. If it’s all over the press, it’s old news.

Few points of interest:

Few points of interest: