Ahh, the famous piggy bank. Call it a piggy bank, money box, change jar….whatever. The point is to put spare change from time to into this container for savings.

Ahh, the famous piggy bank. Call it a piggy bank, money box, change jar….whatever. The point is to put spare change from time to into this container for savings.

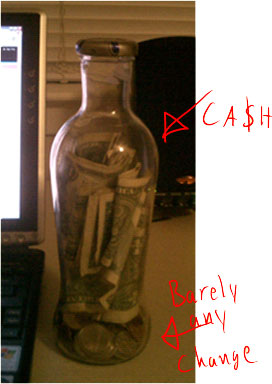

I think the power of the piggy bank is very underestimated. Take a look at MY piggy bank (Actually it’s a 3-year old Snapple bottle).

I stash away spare change AND SPARE BILLS. If I have five $1 bills, I will (without thinking) stash away two of them in the change jar. I do this all the time. I even stash $10’s and $20’s in there at times.

If you use a lot of cash or change, make a subconcious habit of putting some of it away everyday. DO NOT USE THE CHANGE JAR FOR SPENDING. This defeats the whole purpose.

Once, you’ve got a nice amount built up:

- Go to a CoinStar or similar machine that gives you cash for change (at local grocery).

- Get your ca$h.

- Count all cash.

- Deposit all cash into bank.

- Keep 10% or 20% of the money for spending purposes (this will “reward” you for stashing money away).

Since January I will have “made” over $100 from my change jar. Not bad considering it would have just been money wasted in other places.

Also make sure to pickup EVERY penny, nickle, dime and quarter you see laying around. It truly adds up. I was once walking with a multi-multi-MULTI-millionaire who caught sight of a penny from the corner of his eye. Without breaking his line of conversation, he stopped, turned around, walked to the penny, picked up the penny and continued walking with me. He proceeded to carry on the conversation like nothing happened.

I understand why….it’s FREE money. No matter what economic class you are in, you’ve gotta like free money.

This has got to be the simplest form of savings possible. Do it…….NOW.

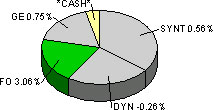

Take a look at my current assets and glance at my Spending Account.

Take a look at my current assets and glance at my Spending Account.

During and after the market hours I tend to glance at my stock prices on Yahoo Finance, but I don’t really look at my gains/losses as I am currently going very long on my stocks. The little changes no longer concern me.

During and after the market hours I tend to glance at my stock prices on Yahoo Finance, but I don’t really look at my gains/losses as I am currently going very long on my stocks. The little changes no longer concern me.

Many people want to be “rich” in the future so they can do things like: Travel, buy nice cars, support family etc…who wouldn’t?

Many people want to be “rich” in the future so they can do things like: Travel, buy nice cars, support family etc…who wouldn’t? An anonymous poster left a post (

An anonymous poster left a post (

Went to Nordstrom to pick up a pair of shorts and some new sandals for summer. Nordstrom is VERY pricey, but if you are looking for a few nice items for longterm use, I suggest buying from them for a few reasons:

Went to Nordstrom to pick up a pair of shorts and some new sandals for summer. Nordstrom is VERY pricey, but if you are looking for a few nice items for longterm use, I suggest buying from them for a few reasons: I’m no “Taxamatician” (yes, that was a joke), but isn’t a tax refund simply a REFUND of money you overpaid?

I’m no “Taxamatician” (yes, that was a joke), but isn’t a tax refund simply a REFUND of money you overpaid?