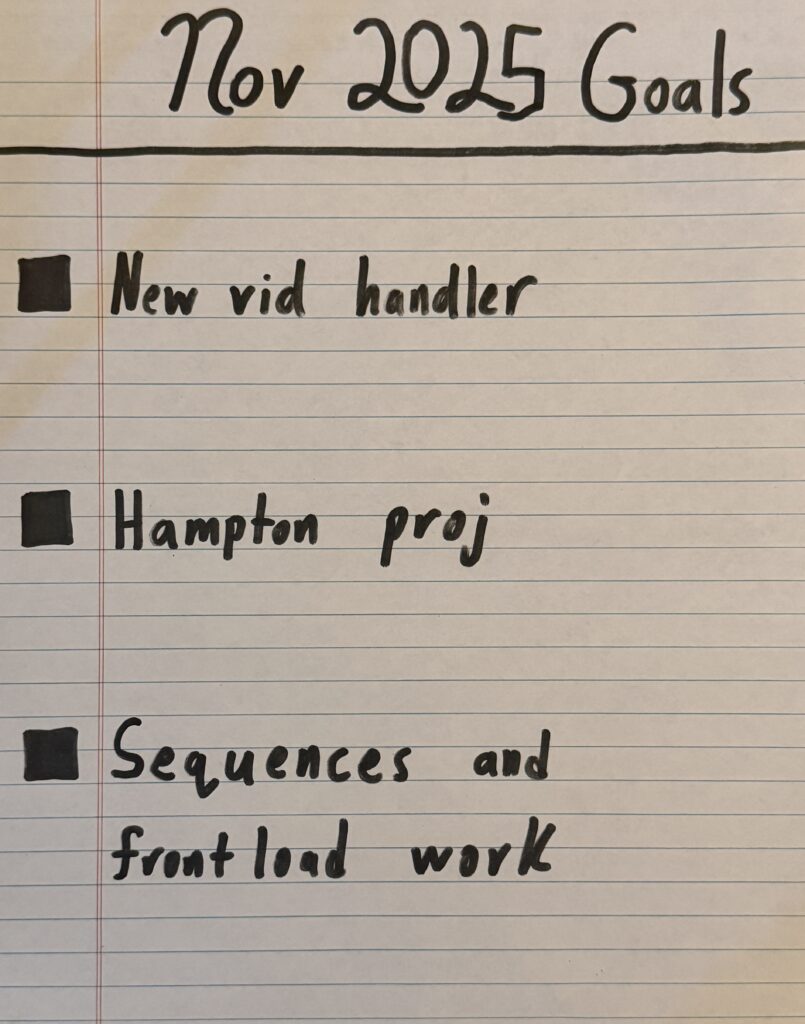

Here’s my November 2025 goals!

Neville's Digital Surrogate Brain

by Neville

Here’s my November 2025 goals!

by Neville

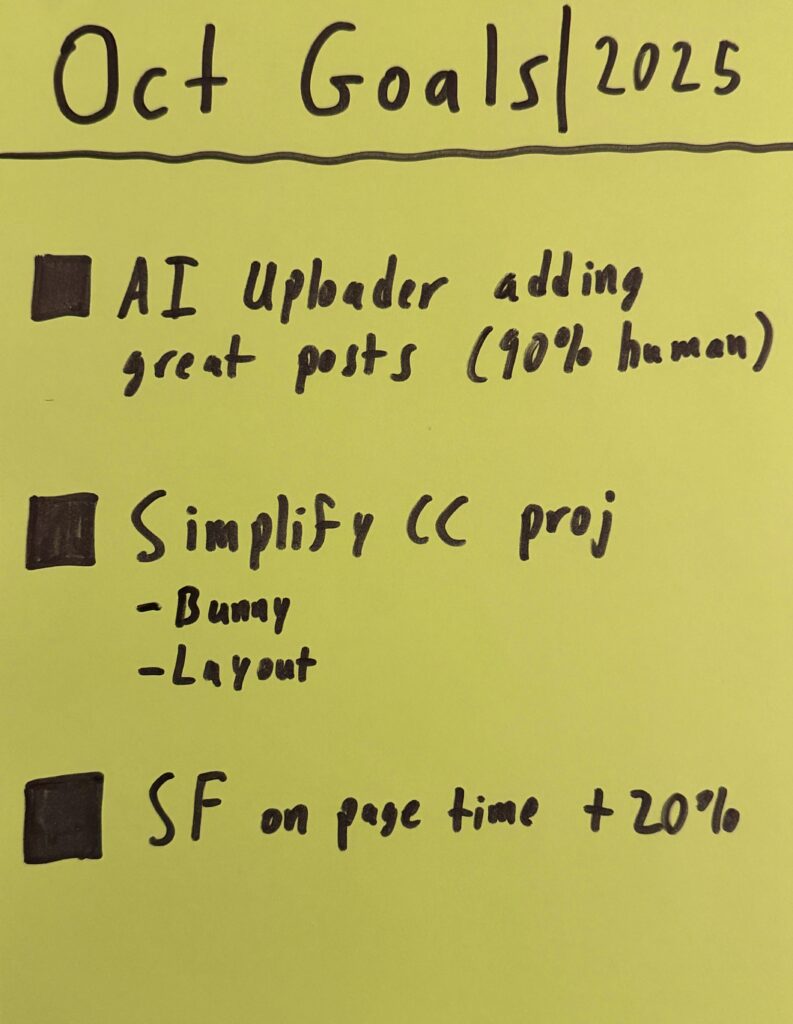

These are my goals for October 2025:

1.) AI uploader for SwipeFile.com adding great posts.

I find so much good stuff I wanna save while browsing the web, but the problem is taking the time to title, describe, tag, and comment on each of these posts. At SwipeFile we have 3 posts go out a day, so that means ~21 things a week to post….it’s kind of like making 21 little blog posts a week.

So to lighten this load we use AI to assist.

THE PROBLEM IS the first version worked really really well….but wrote really really crappy stuff 😂

So the goal is to get this to about 90% human proficiency. We are almost there, as the AI uploader is doing wayyyyyyyy better now.

2.) Simplify CopywritingCourse project.

This is a project to simplify all the moving parts of CC. We’ve already done a few things:

This is all in an effort to make it easy to use as possible. We use a heavily modified forum to run Copywriting Course (so people can post their copy and multiple writers can give feedback), but forums love to add looottss of features we don’t really need. So much of the simplification is simply just removing features that are cool but not needed.

3.) SwipeFile on page time +20%

Every month we try to make SwipeFile pages better, and with the addition of all our AI modules we’re hoping people get way more out of each page, and therefore spend more time on each page.

Have a happy October!

Sincerely,

Neville Medhora

by Neville

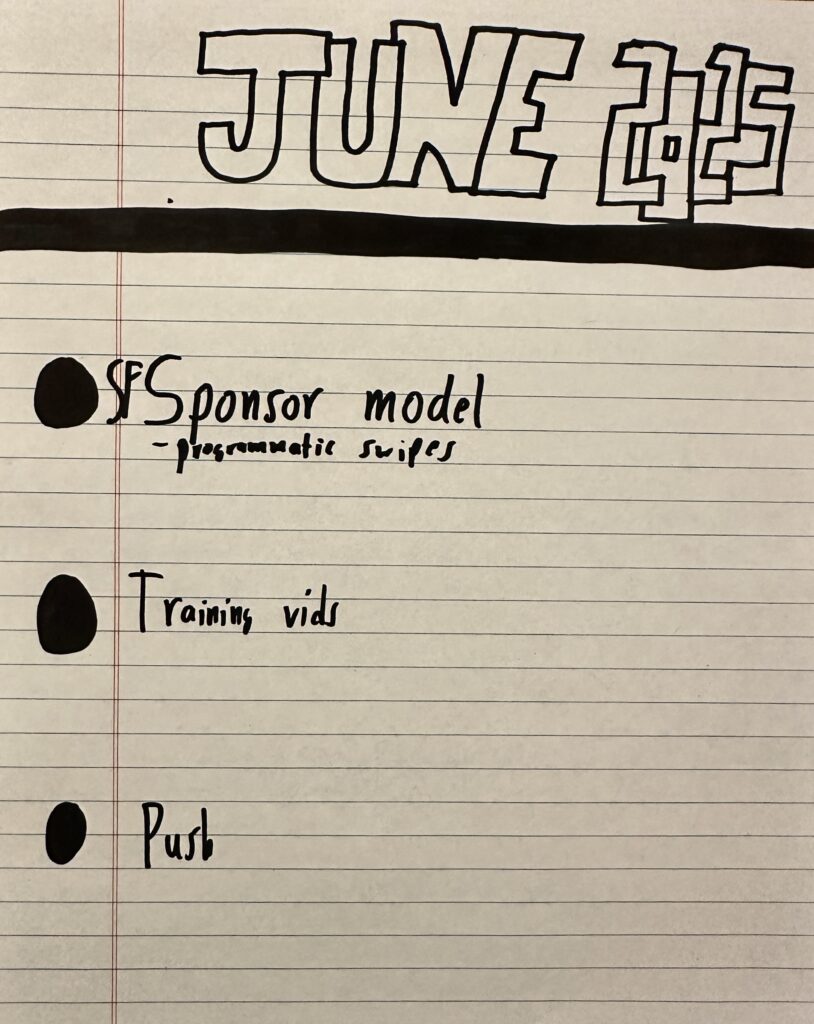

These are my June 2025 Goals:

by Neville

Here’s my May 2025 goals:

by Neville

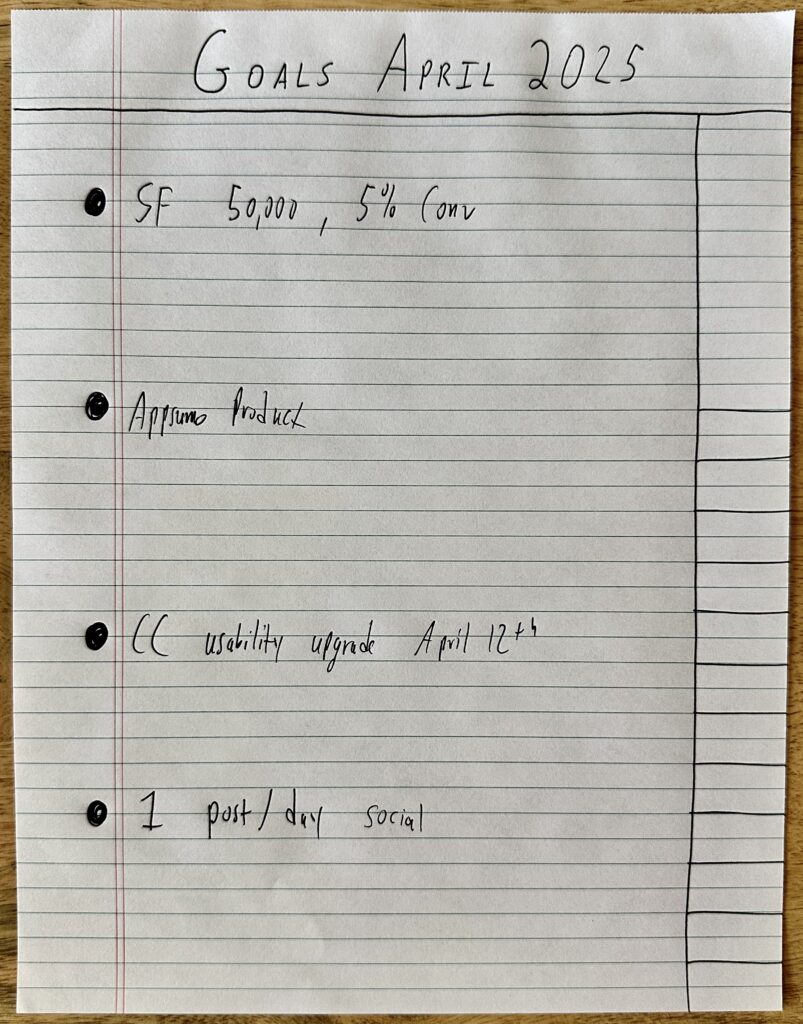

Here’s my goals for April 2025:

by Neville

My goals for March 2025:

by Neville

Here’s my goals for Feb 2025:

by Neville

Here are my goals for January 2025:

by Neville

We asked people what their goals for 2025 are, and a lot of people asked MY goals.

Here’s a running list I’m adding to:

Personal goals for 2025:

– 3 to 6 mini adventures with friends.

– Start new technical project for fun and practice (currently re-vamping SwipeFile, 85% done).

– $Xm cash reserve.

– 1 new skill, likely software or AI related.

– Start getting X/YouTube payments every month. Directly paid for content.

– New book release (75% done)

– Create audiobook of existing book.

– Get the podcast cleaned up (remove swipes), and make the feed useful, grow to 100+ reviews, have a plan.

Copywriting Course Goals for 2025:

– Make it even easier to see all your feedback in Content Dashboard.

– Clip, Tag, and Organize your Office Hours feedback so you can see them in your Content Dashboard. We aim to have the best “Learn By Watching Others” program around.

– Reduce amount of time it takes to get a response in the forum (average low end is 2 hours, average high end is 6 hours generally due to timezone differences).

– Put out 2 really good interviews per month. Clip them up for easy watching + distribution.

– Better member directory for making friends, seeing others websites and social media. We have one but it’s 6/10. Want to make it 10/10 to create connections.

– Make a better goal tracking system. We currently have a Goals Tracker, but want to make it amazing and very helpful.

– Make this so damn useful for people with existing businesses/projects they stay for 3 years or till they’ve outgrown it.

by Neville

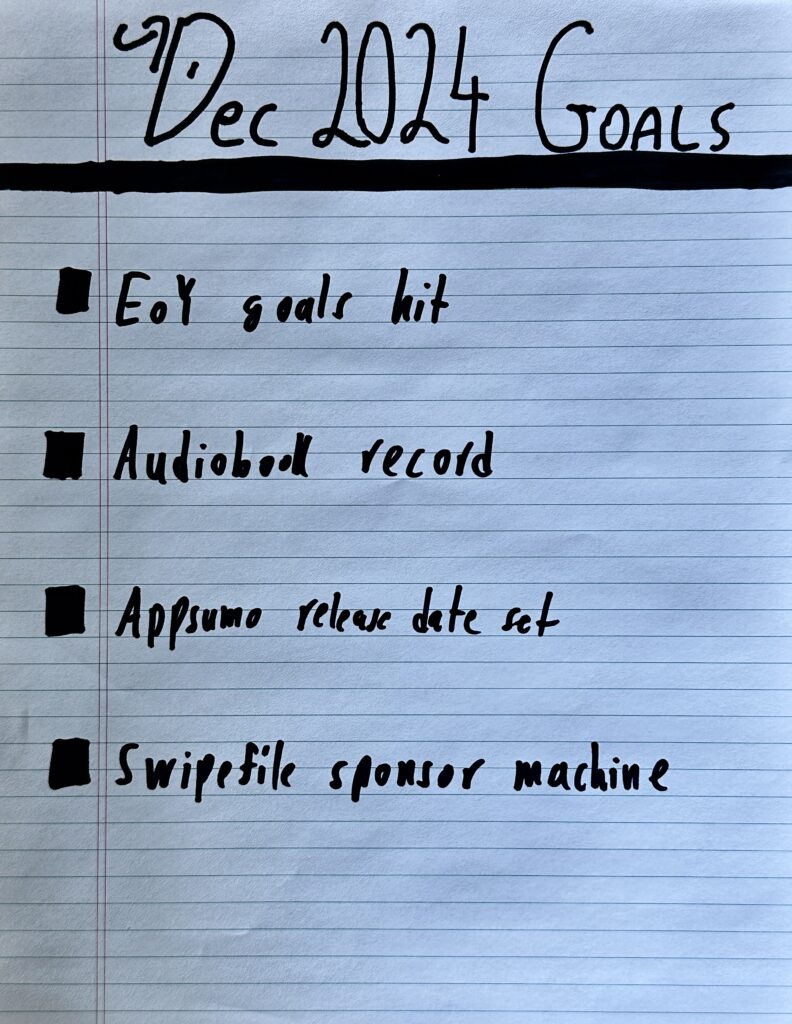

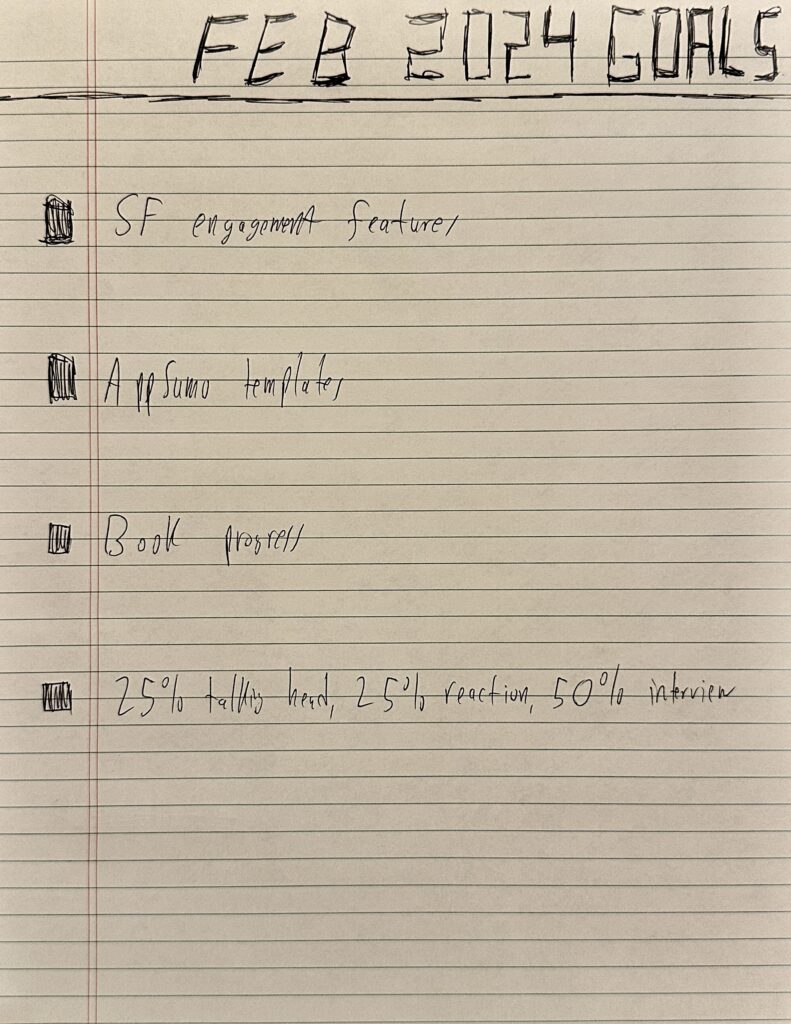

Almost the end of the year, here’s the last goals of 2024 :)